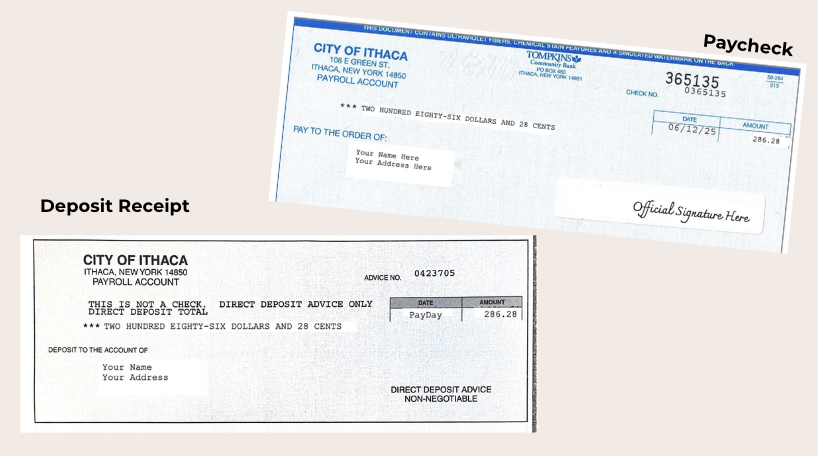

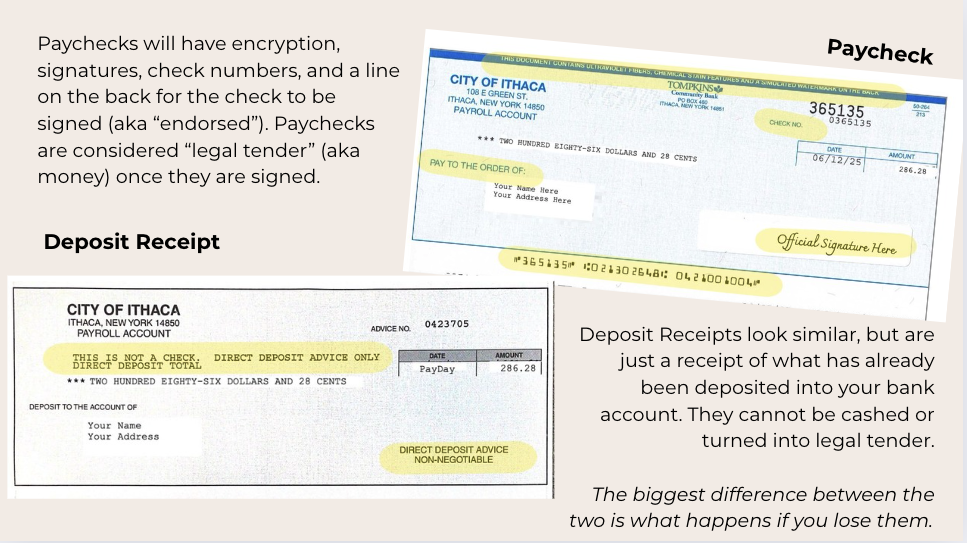

Whenever you work on a company's payroll, you will either receive a paycheck or a deposit receipt. Below are examples of what these documents look like when you work with the YES Program. If you have signed up for Direct Deposit, you will receive a Deposit Receipt. If you have not signed up for Direct Deposit, you will receive a paper check.  Aside from the color difference, there are a few other ways to tell if you are looking at a Deposit Receipt or a Check.

Aside from the color difference, there are a few other ways to tell if you are looking at a Deposit Receipt or a Check.

The most important distinction between these documents is that a Paycheck represents actual money that you need to either cash or deposit in order to use, while a Deposit Receipt is a record of a deposit that has automatically been made into your bank account. If you lose a Deposit Receipt, it's similar to losing a receipt for a purchase-- not ideal, but not the end of the world. If you lose a paycheck before you have deposited it, you will need to request a paycheck replacement to get that money back.

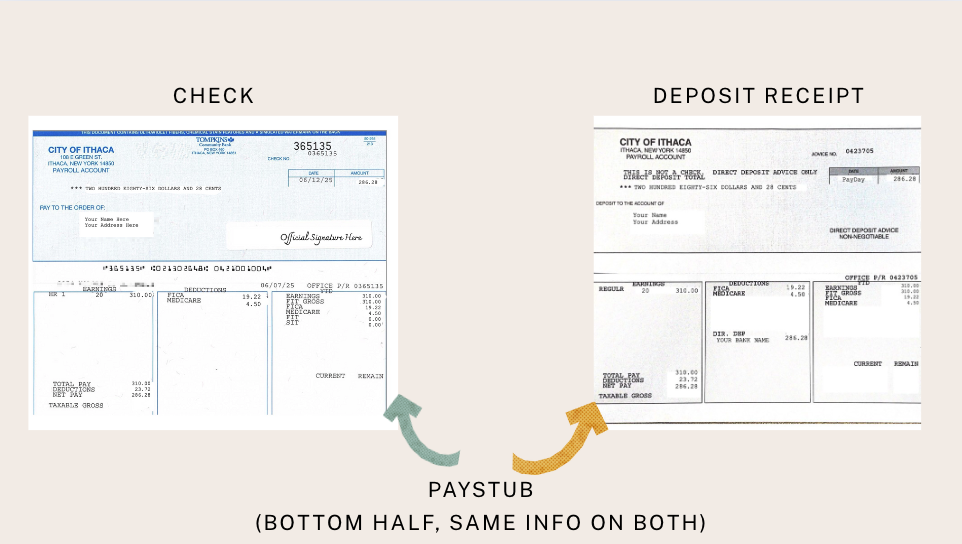

Paystubs

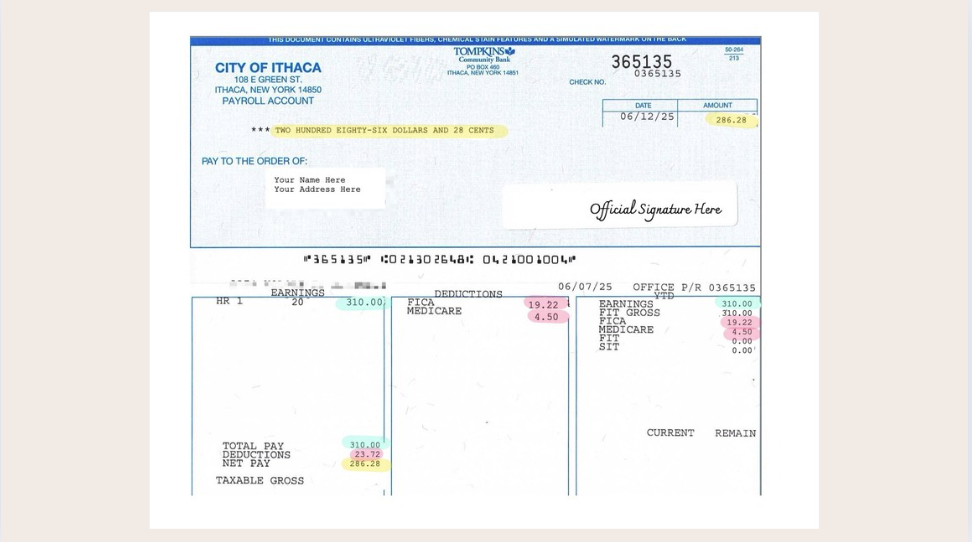

A paystub is a document that accompanies your paycheck/deposit receipt and goes into greater detail on the dates and hours for which you were paid, as well as any taxes or deductions made to your total (gross) pay. Sometimes this document is a separate piece of paper, and sometimes it is physically connected to the check, with a perforated line so the two can be separated. Paystubs are an important part of your financial record keeping, and should be saved whenever possible, regardless of whether you are receiving a physical check or a deposit receipt. While working in the YES Summer Jobs Program, we recommend you keep your deposit receipts in your Red Folder from Orientation, or another safe location in your home.

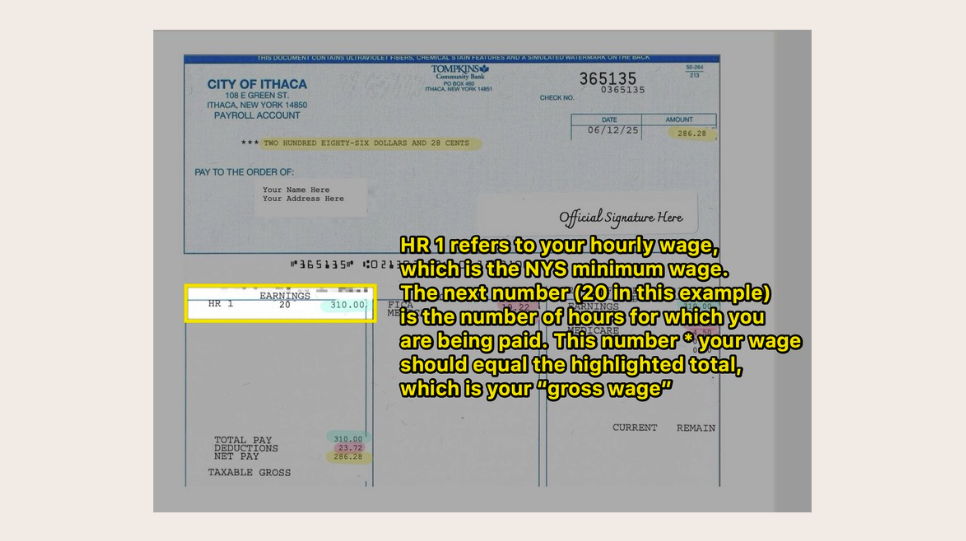

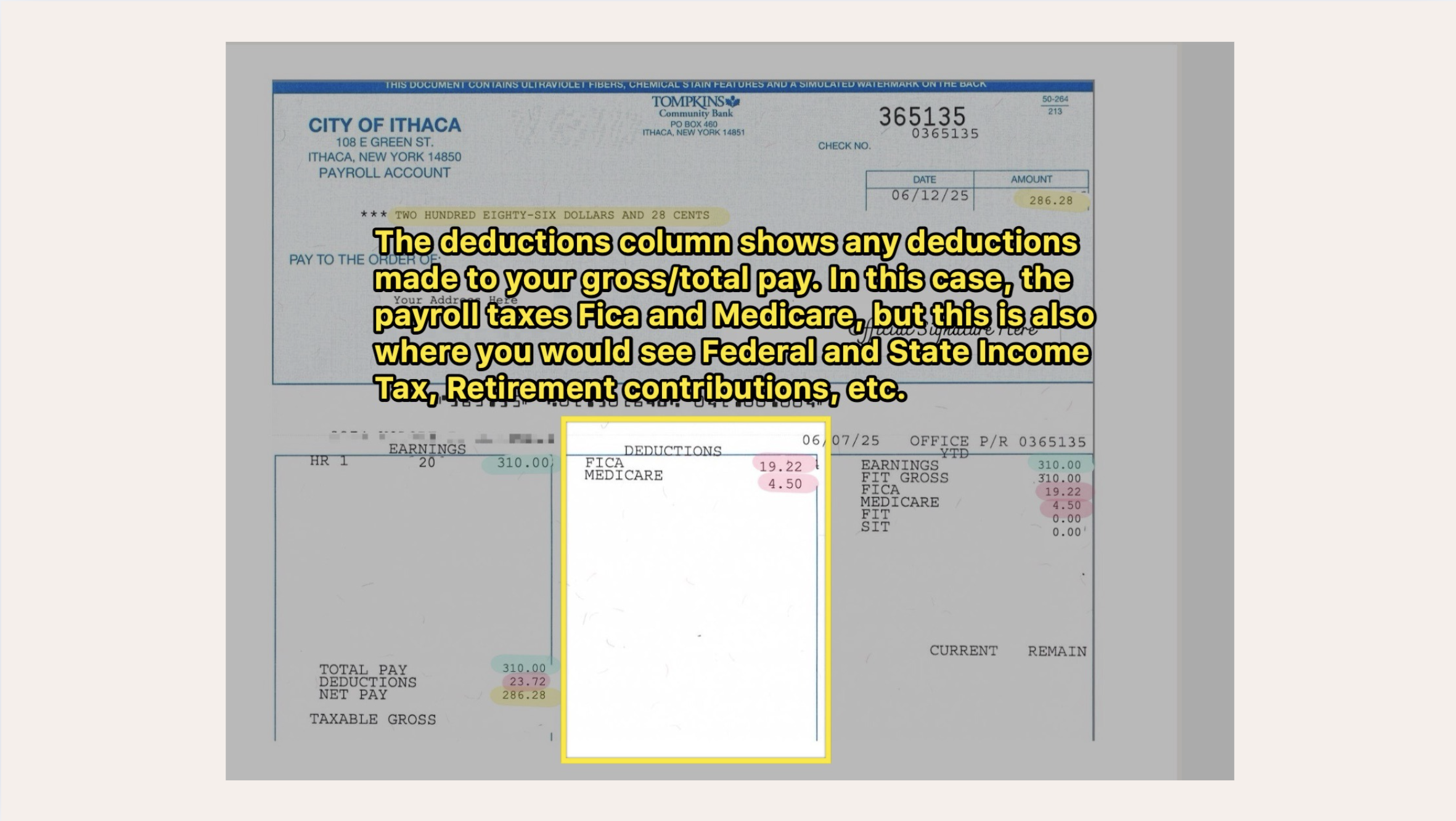

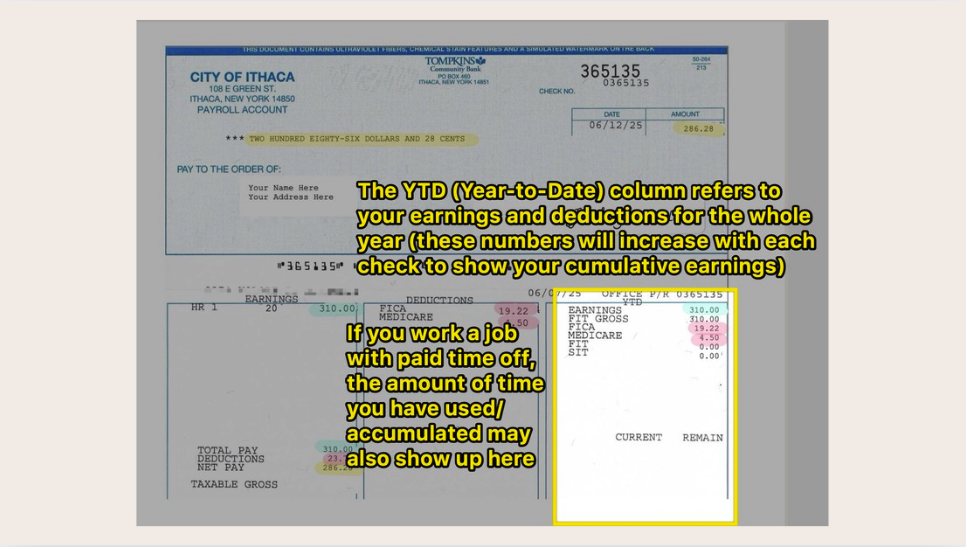

Let's look at a few features of the paystub in greater detail:

The Earnings Column shows the hours for which you are being paid. That number multiplied by your wage (which is $15.50/hr in 2025) should equal the number on the right side of the column. This number is your "Total Pay" or "Gross Pay". This number should also correspond to the total hours from the timesheet you submitted.

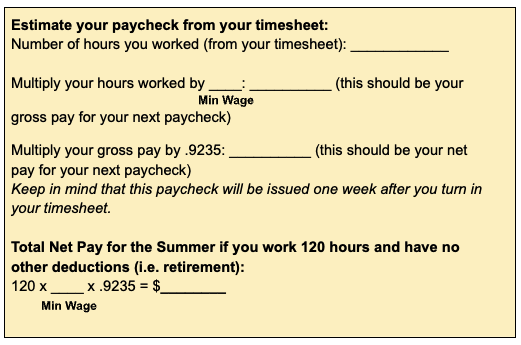

The deductions column will show any deductions or taxes that have been taken out of your check. Some of these are voluntary, like retirement accounts and tax-advantaged savings, and others will are mandatory, like certain taxes. For YES Teens, the typical deductions you will see are FICA (also known as Social Security) and Medicare, which are required for all people working in the United States. These deductions combine to 7.65% of your gross pay. This means that your net pay should be 92.35% of your gross pay.

If you have elected to participate in the NYS retirement program, you would also see a deduction of 3% with the title "EMP RET 6".

The far right column has the heading of YTD, which stands for Year-to-Date. This column will show you a cumulative total of your gross earnings and any deductions that have been subtracted for the whole calendar year.

In the image above, you can see your Gross Pay highlighted in blue, deductions in red, and your Net Pay in yellow. Remember that your Net Pay is what you will actually be able to cash, deposit, or spend. Use the table below to calculate your Net Pay from any timesheet you submit.

Thirsty for more?

This interactive activity will test your ability to read and analyze a sample paystub.