At YES, we believe one of the most important aspects of the program is gaining autonomy (which means personal control) over your money. Whether you save or spend your money is a personal decision, and there are benefits and learning opportunities no matter what you do. That said, most YES Teens choose to save at least some of the money they make and there are some unique advantages to saving money at this point in your life.

The Benefits of Saving

- Building a good habit: Building a saving habit is a smart idea because it gets you used to the idea of living within your means and building a financial safety net, which are two of the most fundamental Money Skills. Getting used to saving now will make it easier to continue doing as you earn more money and your expenses rise.

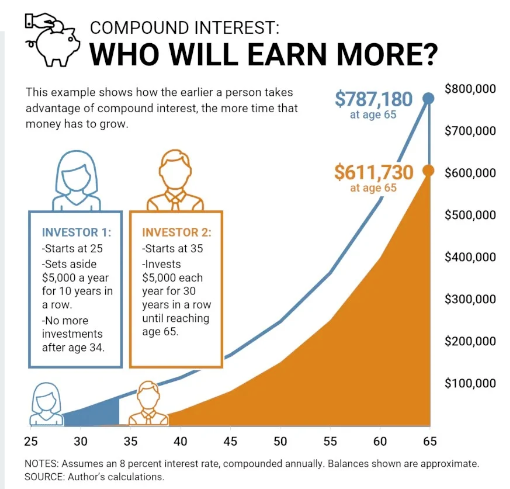

- When you start matters: One unique advantage you have right now in saving is your age. Saving and investing are long-term money strategies that work best when done over many, many years. Savings accounts typically have an interest rate, which the financial institution applies to the balance of your account each month. This is known as compound interest, and over time it creates massive effects. Consider the chart below, where one person begins saving money at age 25 and stops after 10 years, and another person begins at age 35 and continues for 30 years. Starting your savings journey young, even at a small level, can create an unbeatable advantage compared to starting later.

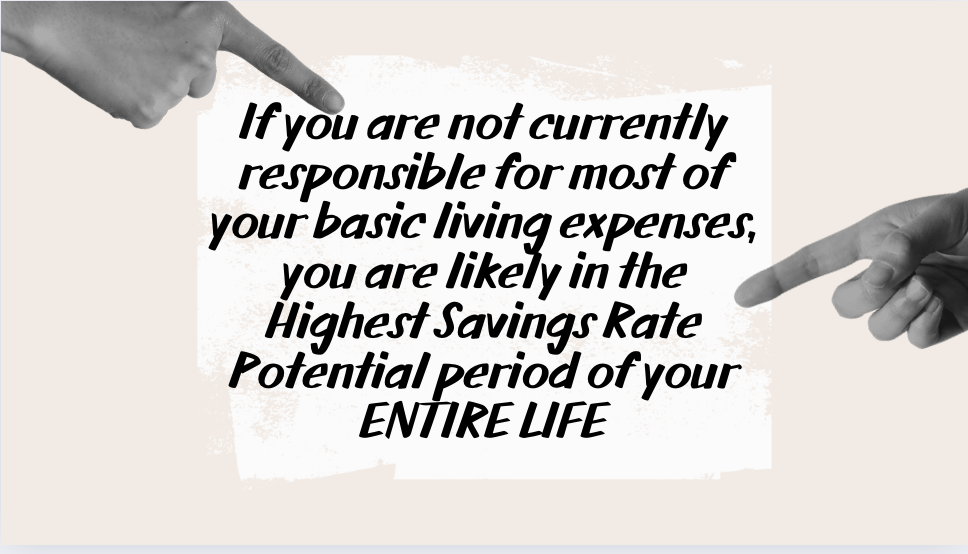

- You have very low expenses: Most YES Teens are not responsible for the majority of the costs of their living. Someone else is usually covering your necessities like housing costs, insurance and medical care, wifi and transportation, food, and more in many cases. You are also exempt from Federal and State income tax, so you get to take home more of your money than most adults. This means that the percentage of your income you can potentially save is the highest it will probably ever be.

- At some point, perhaps after high school or for some, after college, you will take on full financial responsibility for yourself. You will have a lot less margin for saving once you have to pay your own bills, and for many people, these first 5-10 years on your own can be some of the more challenging years of your financial life. This isn't necessarily because of bad decisions, but because there are many big life transitions going on at the same time and you will only be at the beginning of your career journey. Having a stash of savings during this period of life can really help ease the stress and anxiety of these new responsibilities, and keep you from being forced into a snowball of less ideal money choices, like getting into too much debt.

Choosing a Savings Goal or Savings Rate

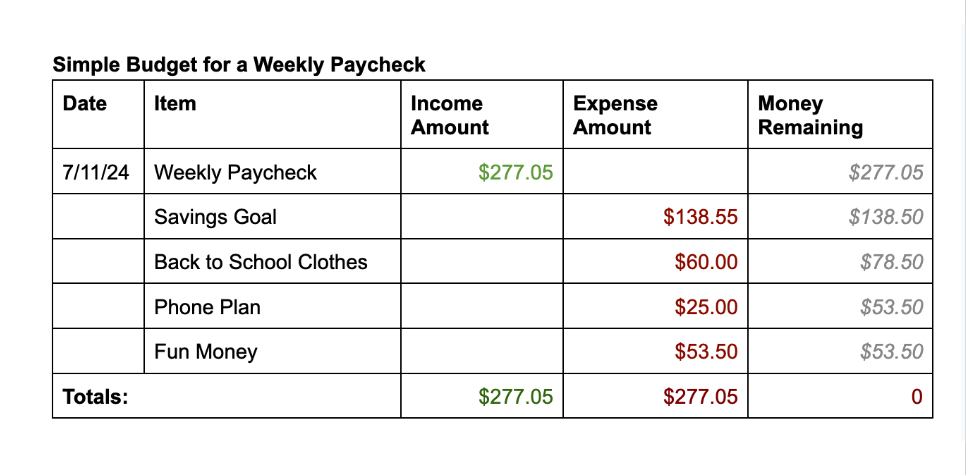

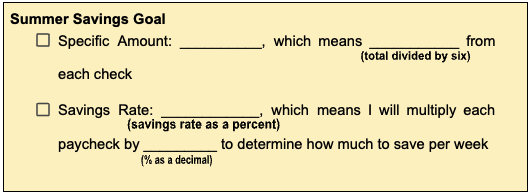

If you have a specific expense or amount you are saving up for, we recommend dividing this total amount by 6 (most YES Teens receive more than 6 checks, but some of them will be for partial weeks and therefore smaller). [Goal: $1000 Safety Net $1000/6 = $167 from each paycheck ]

If you don’t have a specific expense in mind, we recommend choosing a Savings Rate, which is a percentage of your weekly pay you want to save. You can pick any percentage you want, but here are a few popular ones:

You mostly want to spend your money: 25% Multiply paycheck by .25 and move this amount to savings each week.

You want to save some and spend some: 50% Multiply paycheck by .50 and move this amount to savings each week.

You mostly want to save your money: 75% Multiply paycheck by .75 and move this amount to savings each week.

This worksheet in your Money Skills booklet can help you determine how much to save from each paycheck, depending on your goals

Budgeting

A budget is a plan for how you will spend and save your money. When used regularly, it can be a helpful tool to make sure your spending lines up with your larger goals.

Create a Budget: Track your income (money you earn) and expenses (money you spend).

Income: Include your allowance, part-time job earnings, or any other money you receive.

Expenses: List everything you spend money on, like snacks, clothes, and entertainment.

Your budget should be a reflection of your needs, wants, and values. No two budgets will look exactly alike.

Budgets work best when you have relatively fixed income and expenses at a monthly level, which is often not the way things work for teens. But you can practice by budgeting your weekly paycheck.

Set Spending Limits: Allocate specific amounts for different categories, such as:

Needs: Essential items like food, transportation, and savings.

Wants: Non-essential items like entertainment and snacks.

Review Regularly: Check your budget every week to make sure you're staying on track. Over time you may choose to adjust your budget categories and how much you put in them based on your behavior and goals.

A budget is only valuable if you use it to make decisions and stick to it as best you can. Otherwise it is just an act of imagination.

One of the challenges of budgeting as a YES Teen is that you are less likely to have recurring bills and expenses, and you may only be making money some of the time. Typically, budgets are made at the monthly level, because most fixed expenses like rent, utilities, etc. happen on a monthly basis. This is also pretty challenging to do when you only have a six week job.

If you want to experience budgeting as a YES teen, we suggest creating a budget for your weekly paycheck instead. Here is an example of how you might fill out the budgeting worksheet included in your booklet.