One of the simplest things you can do to create a healthy relationship with money is to be in the habit of knowing where your stand financially. In order to manage your money well, you really need to know what you have and where it's going-- this may seem obvious, but 22% of Americans actively avoid looking at or engaging with their finances at all (we call this Financial Avoidance). Avoidance functions similarly to procrastination-- it is an somewhat unhelpful coping response to the fear and potential pain of dealing with the issue, which only grows the longer it isn't addressed.

You are at the very beginning of your financial journey, which is why starting strong with good habits can make such a difference. Checking in briefly with your money on a weekly basis will help you learn your own patterns and tendencies, as well as spot anything out of the ordinary that needs your attention.

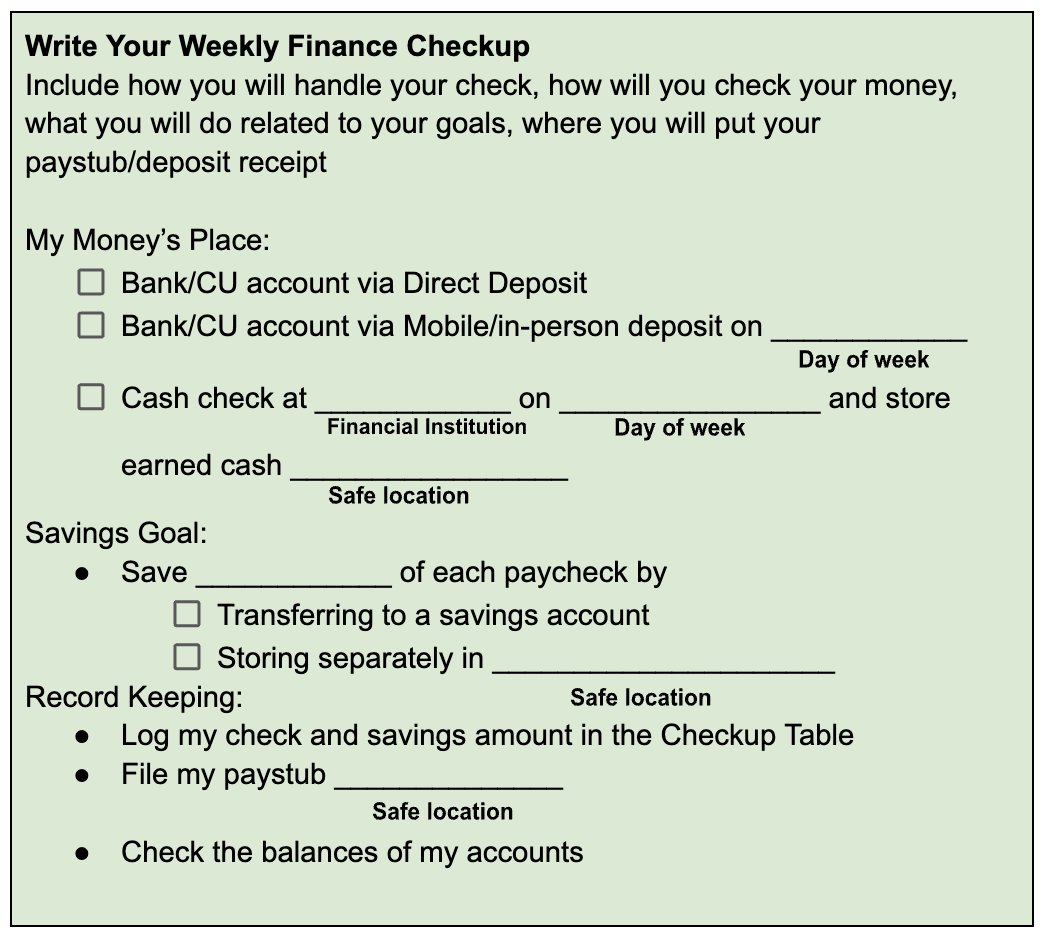

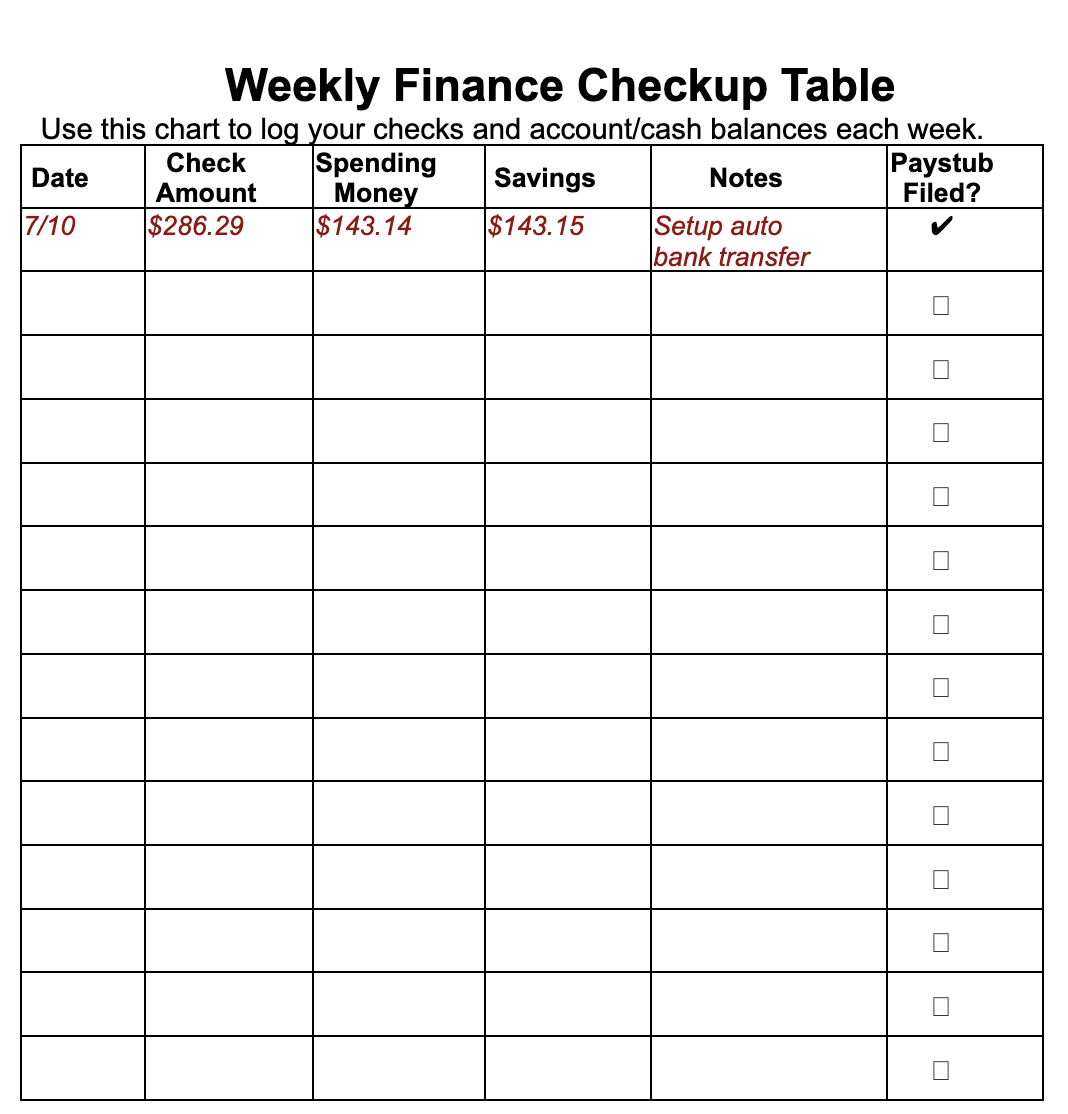

Now that you understand your paycheck and have a plan and a place for your money, it’s time to build out your Weekly Financial Checkup. Every time you get paid, log your paycheck amount, check your bank balances, transfer money according to your savings goals, and put your paystub or deposit receipt in a safe place. This only takes a few minutes each week and will help you stay in the driver's seat of your financial life. How you do this will depend a bit on whether or not you are using a bank account.

Cash Example: Every Thursday afternoon I will pick up my check after work and go with my mom to the bank to cash it, I will add the money to my money envelope at home and update the total on the front, I will put my paystub in my red YES Folder behind the others, and I will move $40 from my cash envelope into the envelope marked “Savings”

Direct Deposit Example: Every Thursday morning I will log into my bank account and check my balance, I will update my personal finance table with my current balance, and I will transfer $40 from my checking account to my savings account. When it arrives in the mail, I will put my deposit receipt in my red folder.

Use the table in your booklet to fill out your own:

Some people like to track their finances using spreadsheets and finance apps, but you can also do it in a note on your phone or in a simple notebook. It's important to find the system that you will use consistently and enjoy doing. We have created a simple Weekly Finance Checkup table in your booklet to use for the summer, if you like.

Note that the basic financial checkup is really only about looking at what you have earned and what your current balances are. It does not look closely at your individual expenses. If you are earning money but your weekly balances are declining, that's a clear indication that you are spending more than you are making. To get the clearest possible view of how you are doing financially, especially if you believe you are spending more than you should be, you need to also be tracking your expenses. This tool can help you track your expenses week by week.