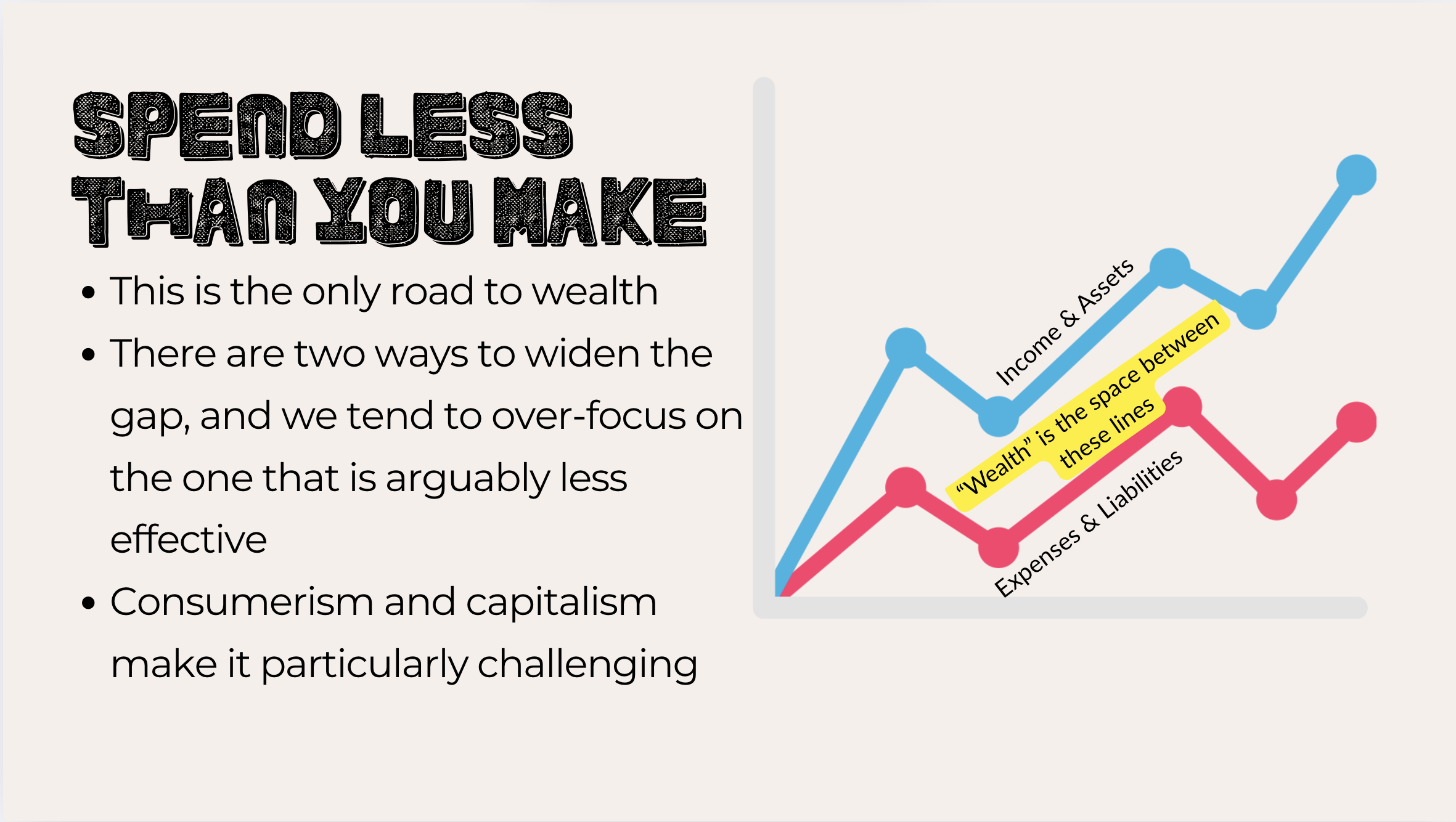

This is the foundation of financial well-being. You can’t achieve any of the other skills unless you are regularly sticking to this one.

Another phrase for this skill is “Live within your means” or “Don’t spend money you don’t have”.

The gap between your Earnings and your Spending is where your wealth grows. The larger that gap, the faster your wealth is growing.

In order to know you are practicing this skill, you will need to have good Money Hygiene. At a minimum, you will need to track your income and account balances each week so you know whether you are earning more than you are spending. Budgeting and tracking your expenses more closely will become important as your financial life gets more complex.

This skill is the most important, but one that our culture and economic system can make incredibly difficult. Get creative about how you can either cut your expenses or increase your earnings.

What Kind of Spender are You?

Take the quiz to find out (there is no wrong answer, but your "spending type" can give insight into how you make decisions about money, and where your trouble spots might be.

Thirsty for More?

Play the free game from NexGen Personal Finance called Spent, which simulates the experience of living paycheck to paycheck.