A Plan for Your Money

Whether you want to save your money or spend it, you need a reliable plan for how you will be dealing with your money. If you have a bank or credit union account and direct deposit setup, your plan is mostly taken care of for you! If you will be picking up a paper check or receiving it in the mail, you need to have a plan for when and where you will deposit or cash the check.

Cash or deposit your checks promptly. Do not save up your checks to deposit all at once! Checks expire and are a pain to replace if they are lost, and cashing/depositing all at once can create accounting challenges for your workplace. In our experience, the longer you wait to deposit or cash a check, the more likely something bad will happen to it. If you do lose a check, please reach out to your YES Rep right away to let them know.

Without a bank account: City of Ithaca Paychecks are issued by Tompkins Financial which means this bank can cash YES checks even if you don’t have an account there. You will need to show a government ID (passport, learners permit/drivers license, or Non-Driver ID) to cash the check. You could also sign the check over to your parent/guardian for them to cash on your behalf. [In order to sign a check over to someone else, you will need to sign your name on the back of the check where it asks for a signature, and on the line below write: “Pay to the order of” and then the full name of the person who will be cashing the check. Make sure you trust this individual as the money will now legally be theirs.] A final option is to use check cashing services at places like Walmart, but be aware that most of these places do charge a fee for the service.

With a bank account: If you do not have direct deposit but do have a bank account, you will be able to deposit the check to your account either at a branch location or using a mobile banking app. If you use a mobile banking app to deposit your check, make sure you save the check until the money shows up in your account.

Make it a habit: Try to pick a reliable day of the week when you will deal with your money. Depending on your Paycheck Option, you may need to wait on the mail, and if you will be going to a bank in person, make sure you know the hours of your bank branch and have transportation.

Part of your plan includes what you intend to do with your money. We cover this more in Savings Goals and Budgets

A Place for Your Money

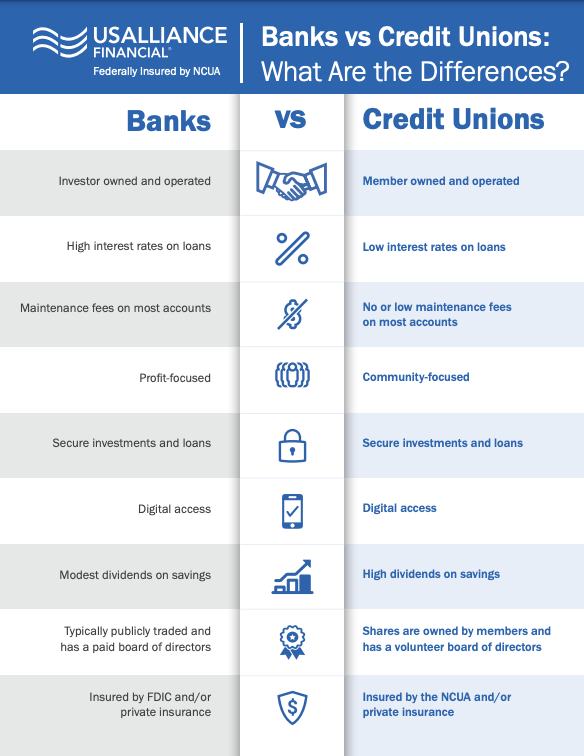

Your money needs a safe place. For most of us, this place is a financial institution (aka a bank or credit union). Banks and Credit Unions carry special insurance so that no matter what happens to a physical branch, your money is secure. Most banks and credit unions have online and mobile access as well so you can check the status of your money without going to the bank itself.

Difference between Banks and Credit Unions:

Choosing a bank or credit union to bank with is a personal decision that will depend on your needs and values. One of the most important considerations is how easily you will be able to access and interact with your money. For some folks, having a bank/credit union with lots of local branches is best. For others, a bank with an excellent mobile app and universal ATM access may be key. Some banks also offer checking and savings accounts specifically marketed for teens, with higher interest rates. Some bank accounts are "fee-free", others have a monthly maintenance cost, and some accounts have specific conditions (minimum balances, number of transactions per month, etc) in order to waive monthly fees, so read the account details carefully and avoid a fee-based account if possible.

If you have a parent, caregiver, or close family member who uses a bank or credit union and is pleased with their experience, that is likely a good first option for you. It can be helpful to have a personal resource familiar with how that particular organization works.

Managing your money without a bank account

If you do not have a bank account and do not want one, try to keep your money in a place where:

You are unlikely to lose it

It is unlikely to get damaged in any way

Only people you trust will have access

You can easily see what you have all in one place

You also need a place for your paystubs. This is the bottom half of your check or the deposit receipt you receive instead of a check (if you have direct deposit). Put your paystubs in the same place every week so you have a record of them. Your red folder from your orientation can be a good spot for this. If you lose a paystub, don’t panic, but keeping them is helpful for your own financial records, and is super helpful in the event that you ever need to replace a lost check.